BE THE FIRST TO KNOW ABOUT FUTURE

INVESTMENT OPPORTUNITIES FOR

ACCREDITED INVESTORS

BUILDING WEALTH ONE PROPERTY

AT A TIME

Interested in Investing in Multi-family, Self-Storage, and Commercial Property?

Welcome to Orbit Investments, LLC where we don’t just

buy properties – we build communities.

OUR APPROACH

The United States is expected to experience a significant demand for rental units in the near future. The last recession resulted in an unparalleled shift away from home ownership toward a strong demand for rentals. Millennials want more flexibility without being tied to a house. Baby Boomers are selling their homes and moving to condos in order to avoid maintenance. The last recession also significantly reduced the supply of new housing so much that we still haven’t caught up with the supply even 10+ years later.

While construction financing has become easier and new supply is on the rise, the pipeline for new construction is expected to lag compared to U.S. population growth over the long term. Orbit Investments and its investors are poised to take advantage of these economic and demographic factors by acquiring premier B and C multi-family properties with stable cash flow and long-term appreciation in high-growth markets.

We also consider strategically located self-storage facilities and commercial property with quality upside.

APARTMENT ACQUISITIONS CRITERIA

$4 – $30 Million

Minimum 50+ units (depending on the market, ideally properties large enough to support full-time on-site management and maintenance).

B+ to C+ class multi-family properties in A and B areas, preferably B class in A markets and C+ class in B markets. We also consider A class deals in markets with 2MM+ populations.

Self-storage properties with at least 200 storage units.

Multi-family zoned land large enough for at least 100 units.

Stabilized properties with a minimum 85% occupancy are preferred. We will consider lower occupancy if the property is well–located and has substantial value-add upside.

Multi-family properties only Arizona, Texas, Florida, and North Carolina.

A to C+ Markets with a minimum 2MM metro population size, a history of strong growth, and strong demographics and economic diversity.

Self-storage units nationwide where the deal makes sense.

Preferrably 1978 and newer, but we’ll consider properties of any age.

Flexible (based on current financials).

6% to 10% annual cash on cash return (based on current financials)

15% min IRR over investment period

5–10 year hold period (on a case-by-case basis)

Potential high-yield income streams for buy and hold properties

At or below replacement cost

Value-add opportunities

- Utilities: Individual metered units preferred

- Roofs: Pitched roof construction preferred, but not required

- Premier Properties: Stabilized properties with some deferred maintenance preferred, but will consider others if well located and possessing a strong, value-add opportunity

FEATURED PROPERTIES

OUR PROCESS

Orbit Acquisition FilterTM

We thoroughly analyze 95% of all deals in our targeted markets through this vigorous filter, which typically leaves only 2% – 3% qualifying for further review. This strict filtering process ensures that only assets that meet our conservative underwriting, with a focus on cash flow for investors, get selected.

Orbit Due Diligence Audit TM

When on-site, our team of experts inspect & analyze all financials and the physical condition of the property to mitigate potential risks and uncover opportunities for our investors. Only qualified deals move forward.

Orbit Management Advantage TM

Our systematic team approach to performance, KPI’s and people constantly elevates our communities to the highest standards. This ensures predictable investor cash flow and appreciation.

Orbit Investor Return Maximizer TM

This process utilizes a value and cash flow-centric approach, driving profits to the bottom line, while optimizing the asset’s overall value. This positions the property for a proper and profitable exit for our investors. With return of equity and profits, our investors are now positioned to take advantage of the next Orbit acquisition.

OUR EXECUTIVE TEAM

MICHELLE BOSCH

CEO and Co-Founder

As CEO of Orbit Investments, LLC, Michelle is responsible for overseeing the company’s vision and ability to achieve growth goals both now and into the ensuing future. Prior to this position, Michelle held positions as CFO and COO of Orbit Investments and CEO of Orbit Publishing, LLC. Together with her husband Jack, she has built multiple 8-figure companies, including the 3rd largest land auction company (selling only their own properties) in the United States. Under her leadership Orbit has bought, sold and managed thousands of properties across the entire United States. Michelle also led the coaching company she and her husband Jack created to 8-figures as CEO, particularly during the difficult COVID Years. Michelle holds a Masters of International Management from the prestigious Thunderbird International School of Management and a Bachelors of Business in Finance from Western Illinois University.

JACK BOSCH

COO and Co-Founder

As a key part of leadership, Jack is responsible for overseeing the day to day operations of the property acquisitions, and management of the assets. Prior to this position Jack held positions as COO and Managing Director of Orbit Publishing, LLC. Jack and Michelle Bosch also built a successful 8-figure real estate education company focusing on teaching others how to invest in real estate. Jack is also a #1 bestselling author of the financial literacy book “Forever Cash: Break the earn-spend cycle, take charge of your life, and build everlasting wealth.”

SARAH PINGER

Asset Manager / Designated Broker

With almost 10 years of real estate experience and an incredible attention to detail, Sarah’s expertise includes being a residential real estate agent and Designated Broker for Security Home Rentals LLC, an Orbit Investments owned company. Sarah has worked in the service industry her entire life, making her #1 goal the satisfaction and happiness of our investors and clients. She oversees investor relations and implements property improvement plans via weekly online meetings with our property management companies. She has been involved in over $20M worth of real estate transactions and holds a Bachelors of Science in Business Marketing from the University of Phoenix.

ADAM WILCOX

Acquisitions Manager

Adam is proficient in the fundamentals of micro and macroeconomics coupled with 7 years of real estate experience in various facets of the industry. Adam’s expertise in real estate ranges from residential sales, ground lease acquisitions in cellular infrastructure, and multifamily acquisitions. Adam has been involved in over $50M worth of real estate transactions and acquisitions.

FREQUENTLY ASKED

QUESTIONS

We currently solely invest in multi-family apartment buildings, one of the most recession proof segments of the Real Estate Market, particularly with the United States population continuing to grow. Even with the continued advancements in online marketing (particularly Amazon) and “work from home” which threatens the retail and office markets, people will always need to live somewhere. Within this segment, we focus on B+ to C+ class multi-family properties and prefer B class in A markets and C+ class in B markets. We believe this positions us in the segment of the market that is shielded most from the ups and downs in the economic cycles. We will also review distressed A class deals in markets with 2MM+ populations.

To qualify as an accredited investor, a person must demonstrate an annual income of $200,000, or $300,000 for joint income, for the last two years with expectation of earning the same or higher income. An individual must have earned income above the thresholds either alone or with a spouse over the last three years. Or A person is also considered an accredited investor if he has a net worth exceeding $1 million, either individually or jointly with his spouse excluding personal home.

Unfortunately no, you have to be an accredited investor to participate in our deals.

We have relationships with the vast majority of all commercial brokers in the Central and Eastern US, who bring us deals often before they go on the open market. We also occasionally engage in direct marketing campaigns and are constantly building relationships with banks to get access to their REO inventory. Once presented with an opportunity our team then underwrites every single property to the highest standards and eliminates those that do not qualify at our rigorous standards. As an example last year our team underwrote 726 properties and with only a little over 20 qualifying for our stringent standards.

All our investment and Private Placement Memorandums are based on individual properties, and every property is different and will therefore offer different returns. Our current investors are right now realizing between a 6%-8% preferred cash yield annually, and are expected to double this return upon the sale or refinancing of the property for overall investment lifecycle returns of 10%-16%. Our returns consist of three parts: Preferred Return from Cash Flow: Each investment is selected such that it pays an min. average annual preferred return of at least 6% (depending on the individual property deal this could be higher than that) which is paid out quarterly via direct deposit into your bank account or by check. In other words, the investors get paid first before the sponsors get paid anything. This protects you as an investor and makes sure we only pick projects that have strong cash flow outlooks. Profit Share: Upon a Sale or Refinancing of the property it is our goal to return 100% of the initial invested amount to each investor, and then do a 50/50 profit split between sponsors and investors up to the point where investors doubled their annual return from the Cash Flow (so if Preferred Return from Cash Flow is 6% the profit split is 50/50 until they reached a total “Target Return” of a 12% per year return over the holding period)

This is an exciting point. Over a 5-year period it is our goal to have our properties not be more than 50-60% leveraged. While we start out with a 75%-80% leverage based on purchase price, we decrease that ratio rapidly by actively paying down the loan and by forcing appreciation of the property through value add improvements, superior management, and rent increases, leading to a 5-year loan to value ratio of no more than 60%. This conservative approach provides additional buffer from the ups and downs of the real estate market.

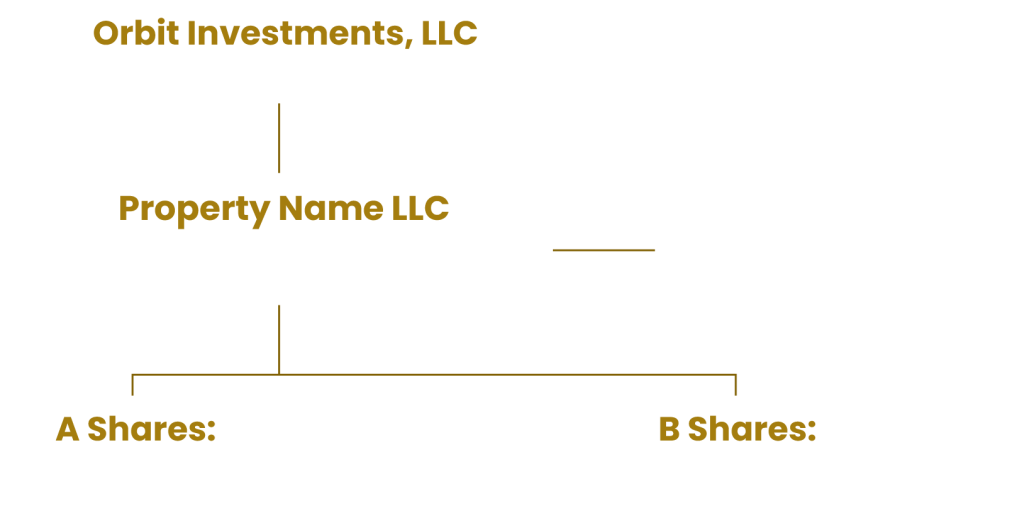

Great news. You will be limitied liability owner of the property which comes with all the benefits like depreciation and cash flow, meaning the property is owned by a “Property LLC” for which that property is the only asset (reduces liability). You in turn will be a direct shareholder in this Property LLC so in essence you are part owner of the company that owns the property. This allows for a direct flow-through of cash flow, depreciation, and allows you upon sale of the asset to realize long term capital gains … PLUS, you literally get to tell your friends you “own” an apartment complex, because you do.

Yes, investing in Multi-Family in a structure like ours is perfect for retirement plan investing because your involvement is by definition passive. All you need to do, if you haven’t already, is set up a SELF-DIRECTED IRA with an independent custodian, like www.IRAClub.org and once that is done you can invest using your IRA/401K/ROTH-IRA… or several other self-directed retirement account forms. If you have questions about how to do that, please contact us through the Contact US form or call us at (480) 845-0171

IRA Club

Website: www.IRAClub.org

Phone: (312) 795-0988

20860 N Tatum Blvd #300

Phoenix, AZ 85050

Monday through Friday,

8AM - 5PM (MST)

(480) 845-0171